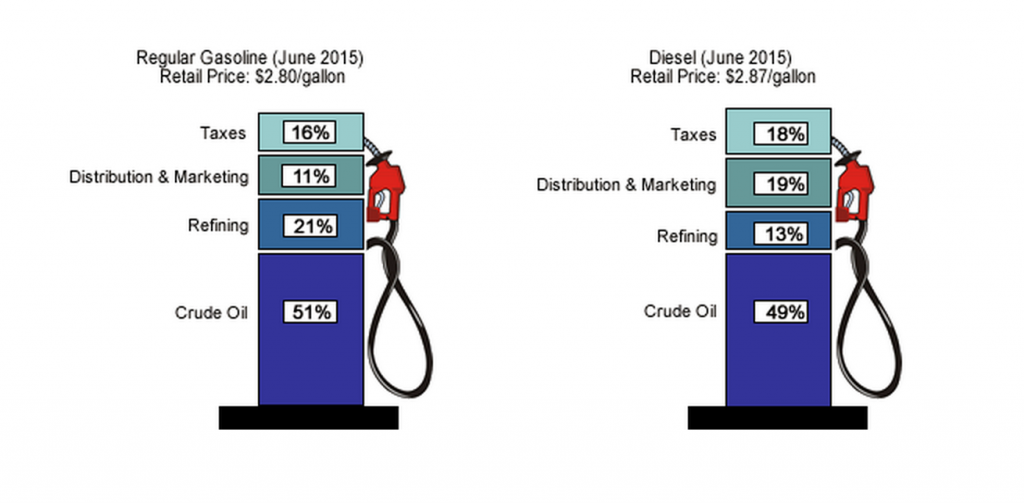

There are four cost components that make up the retail price of gasoline and diesel:

Crude Oil Cost

Crude oil is produced worldwide from various locations, such as tradition oil wells, deep-sea (ocean) wells, oil shale fracturing, and Canadian tar sands. The cost to produce a barrel varies from about $20 per barrel in Saudi Arabia’s desserts to $90 per barrel for some deep-water wells. In the example below, the crude cost is $1.39 per gallon ($58.26 per barrel).

Refining Cost

Refining Cost

Refining is the process that turns crude oil into gasoline and diesel. Refining cost varies depending upon the final product’s specifications and the additives that are used to enhance it. In the case of gasoline, summer gasoline has low vaporization rates, which are required to eliminate excessive air pollution. Further, gasoline is made at different power and performance levels called octanes (i.e. 87, 89, &93) – the higher the octane, the higher the cost to manufacture. Both gasoline and diesel have added detergents, which clean engines and enhance performance. These additives also increase cost. Cost to refine gasoline varies between $.40 and $.70 per gallon, depending on whether summer or winter formulas are being used. In the example above, the cost to refine gasoline is $.60 per gallon. The cost to refine diesel is $.49 per gallon.

Distribution and Marketing Cost

This cost includes transportation of the finished products (gasoline and diesel) from the refineries to central distribution points (petroleum racks) around the country, trucking from racks to retail outlets (convenience stores, gasoline stations, marinas, etc.), and retailing of the products to motorist. Transportation methods include pipelines, railcars, ships, and trucks. Retail cost includes labor, utilities, and petroleum equipment. In the example above, the cost for gasoline transportation and marketing is $.27 per gallon. Diesel, since it is a heavier product, requires higher transportation and equipment costs. In this example, diesel distribution costs $.49 per gallon.

Tax Cost

Excise taxes, which are used for the building and repair of roads and highways, are levied at both the national and state levels. Traditionally, federal taxes are allocated to the states, which combine them with their collections for highway improvement projects. Gasoline taxes in the example above are $.46 per gallon. Diesel taxes are higher ($.52 per gallon) because most diesel is used by heavier trucks, which cause more wear and tear on highways.

Crude and refined product values are determined not only by production costs, but also by supply and demand factors determined daily by commodity traders at the New York Mercantile Exchange. Since costs for marketing, distribution, and taxes are fairly stable, the values of crude oil and refined products established by traders dictate today’s price of gasoline and diesel.

Refining Cost

Refining Cost